Understanding how much small business insurance costs in the US is one of the first questions business owners ask—and for good reason. Insurance prices vary widely depending on your industry, location, business size, and coverage needs.

In this guide, you’ll find real average costs, what affects your premiums, and how to get free insurance quotes tailored to your business.

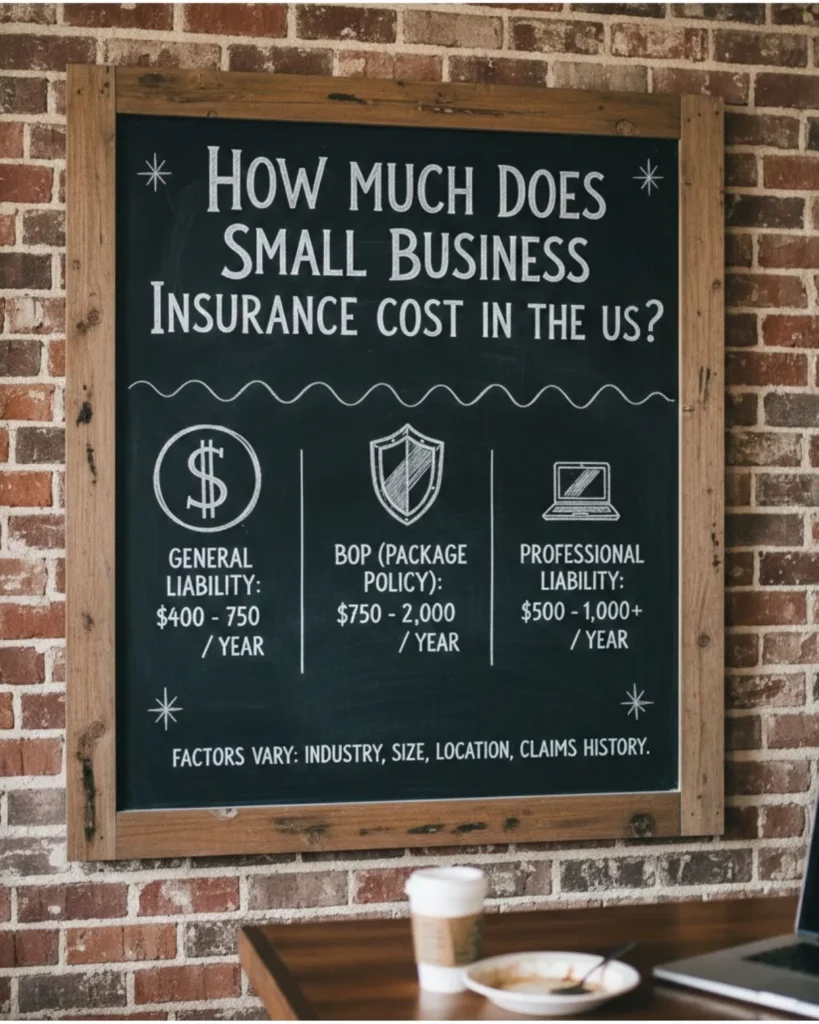

Average Cost of Small Business Insurance in the United States

For most small businesses in the United States, insurance costs are more affordable than many owners expect, especially when policies are bundled.

Typical Monthly Costs (Nationwide Averages)

| Insurance Type | Average Monthly Cost |

|---|---|

| General Liability Insurance | $40 – $85 |

| Professional Liability (E&O) | $60 – $120 |

| Business Owner’s Policy (BOP) | $70 – $150 |

| Workers’ Compensation | $45 – $110 |

| Commercial Auto Insurance | $90 – $180 |

| Cyber Liability Insurance | $50 – $140 |

📌 Most small businesses pay between $70 and $200 per month for core coverage.

What Affects Small Business Insurance Costs?

Insurance premiums are calculated based on risk. The higher the risk, the higher the cost.

Key Factors That Influence Your Price

- Industry type (construction costs more than consulting)

- Business location (state regulations and claim rates)

- Annual revenue

- Number of employees

- Coverage limits & deductibles

- Claims history

💡 A low-risk service business with no employees will usually pay far less than a company with staff, vehicles, or physical locations.

Insurance Cost by Business Type

Different industries face different risks, which directly impacts pricing.

Common Examples

- Consultants & freelancers: $30 – $70/month

- Cleaning businesses: $45 – $100/month

- Landscaping companies: $60 – $130/month

- Contractors & construction: $80 – $200/month

- Retail & food services: $90 – $220/month

Industry-specific coverage is critical to avoid overpaying or being underinsured.

Cost of Business Insurance by Policy Type

General Liability Insurance

The most common policy for small businesses. Covers bodily injury, property damage, and legal defense.

- Average cost: $40 – $85/month

Business Owner’s Policy (BOP)

Bundles general liability and commercial property insurance at a lower price.

- Average cost: $70 – $150/month

- Best value for most small businesses

Professional Liability (Errors & Omissions)

Essential for service-based businesses and professionals.

- Average cost: $60 – $120/month

Workers’ Compensation Insurance

Covers employee injuries and medical expenses.

- Average cost: $45 – $110/month (per employee risk class)

How to Lower Your Small Business Insurance Costs

You don’t need to sacrifice coverage to save money.

Smart Ways to Reduce Premiums

- Bundle policies (BOP)

- Increase deductibles responsibly

- Maintain a clean claims history

- Choose only necessary coverage

- Compare quotes annually

👉 Many businesses save 20–40% just by comparing providers.

Is Business Insurance Required in the US?

There’s no single federal law requiring all businesses to carry insurance, but:

- Workers’ compensation is required in most states

- Commercial auto insurance is mandatory for business vehicles

- Many clients, landlords, and lenders require proof of insurance

Even when not legally required, insurance protects your business from financial ruin.

How to Get Accurate Small Business Insurance Quotes

Online averages are helpful—but your exact cost depends on your business.

Information You’ll Need

- Business type & industry

- Annual revenue

- Number of employees

- Location

- Desired coverage limits

⏱️ Most quote forms take less than 3 minutes to complete.

Get Free Small Business Insurance Quotes Today

The fastest way to find affordable coverage is to compare multiple quotes from providers that specialize in small businesses.

👉 Get Free Small Business Insurance Quotes in the US

No obligation. No hidden fees. Just real pricing for your business.

Frequently Asked Questions

How much is small business insurance per year?

Most small businesses pay $800 to $2,400 per year, depending on coverage and risk.

Is small business insurance tax-deductible?

Yes. In most cases, business insurance premiums are considered tax-deductible expenses.

Can I get insurance with no employees?

Yes. Many solo business owners and single-member LLCs qualify for low-cost policies.

How fast can coverage start?

Many policies can begin the same day after approval.

Small business insurance costs in the US depend on risk, not guesswork. The right coverage protects your business, builds credibility, and helps you grow with confidence.

Comparing quotes ensures you pay only what you need—no more, no less.

Start with free quotes and make an informed decision today.